What do Litigation Funders Look for In Intellectual Property Cases?

The use of litigation finance for intellectual property disputes is well known in the USA and is now growing across European markets.

Not only can litigation finance be used as a tool to provide access to justice for businesses which do not have the financial means to bring their cases, but it can also be a means of removing litigation risk from the balance sheet. This can be useful for start-ups when securing further investment rounds for larger companies looking to invest in operations, or, to safeguard company financial performance from the impact of significant legal bills.

Given that litigation finance is non-recourse (the funder will only receive its investment back and its return from the damages awarded and paid), funded businesses do not need to take a provision for legal fees and adverse party cost risk is usually covered by insurance or the funder may indemnify the company against that risk.

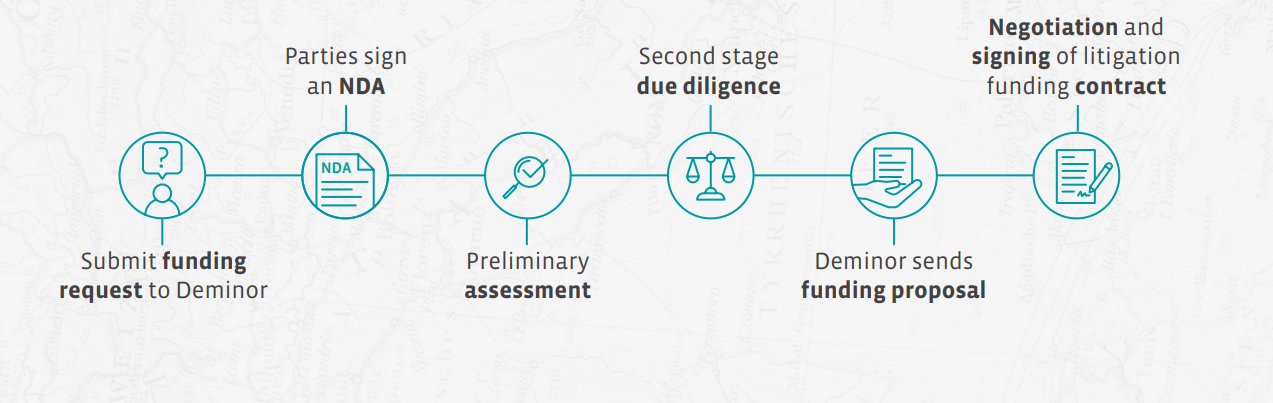

Litigation finance is a high risk investment class. Once a funder has decided to invest in a case, it will have little or no control over the running of that case (depending on the local regulations within the jurisdiction of the litigation). As such, before investing in a case, a funder will conduct a detailed due diligence of the funding proposal.

What does this process look like for IP cases?

The majority of applications for litigation finance of intellectual property cases are for patent cases. This is usually because the damages that can be awarded for patent infringement tend to be higher than those awarded for infringement of other rights.

In addition, the client’s strategy is important as if the client is seeking an injunction then only back damages would be available. By comparison with a licensing strategy where there could be income potential in licensing the defendant to use the invention until patent expiry.

The key elements that a funder will look for in identifying a strong IP case are:

Strong IP Rights

The foundation of the case must be strong. Deminor’s due diligence process looks at the fundamentals of the IP right to check registration.

- For patents this includes a review of the prosecution of the patent and more broadly the patent family where the patent has been validated in a number of jurisdictions. Where a patent has been granted by different patent offices in substantially the same form, this is helpful as validity would have been considered from different perspectives. Where a single patent is presented or where all members of the family are granted in a single jurisdiction, there is not the independent validation (or additional prior art identified) of review by different patent offices.

- For trade marks the due diligence process requires a detailed review of evidence of use by the claimant where the trade mark has been registered for a sufficient time to be vulnerable to non-use cancellation. In reviewing these cases, Deminor looks at the evidence of use spanning the period of registration and across the goods or services that have been infringed.

- For copyright cases Deminor will review evidence showing that the claimant created the work as its own original work product and the evidence in support of the date of creation.

Strong Merits

Deminor provides non-recourse litigation finance.

This means that Deminor will receive its investment back and return only out of damages paid by the Defendant to the Claimant. If the Claimant loses the case or only minimal damages are awarded, Deminor loses its investment. Damages can be paid either arising out of a Court award or under a settlement agreement.

When we review a case, the risk model that we use requires the case to be likely to be successful in Court (not just a high likelihood of settlement). We also look at settlement potential, jurisdiction, likely time to trial and the Defendant’s ability to pay any damages awarded in mapping the risk and calculating our economic terms.

At the start of our review we consider initial indicators of value – these include:

- Assessing the strength of the right being asserted as outlined above

- How many opportunities for success does the Claimant have? How many patents and how many independent claims are being asserted?

- Has the patent’s validity been tested post grant? Has the patent been subject to a previous challenge either at the patent office (e.g. Inter-partes review at the USPTO or opposition proceedings at the EPO) or in Court?

- If the portfolio being asserted includes US patents – are there pending continuations in the chain?

Our early review includes spending time understanding the client’s strategy and business case for bringing the action:

- What was the claimant’s business case for looking to initiate proceedings?

- What is the claimant hoping to achieve? Will it seek an injunction (which would likely reduce the damages pool available for distribution in the event of success) or would a royalty bearing licence going forward be acceptable?

- Has the claimant considered the risk of counter-assertion such as through review of the proposed defendant’s patent portfolio?

Damages Model

Damages in IP cases will depend on the basis claimed for damages such as lost profits or a reasonable royalty and whether an income, market or cost model is used.

When we review a damages projection, it is helpful to include details as to the process and assumptions applied to reach the proposed damages number. Although we appreciate that claimants want to optimise their damages providing an artificially inflated damages projection is not a strong start in building trust between Deminor and the client.

An honest assessment is a far better starting point. If the damages are not significant enough to support a funded case, it is better to understand that at the beginning of the process rather than spending time in a due diligence process to end up at the same point but several weeks later.

Structured Litigation Budget

When we assess risk, we map out our capital deployment over time and against the phases of the litigation. We appreciate that unexpected events can happen as a case moves forward but we like to see a detailed budget broken down by phase and including legal fees as well as disbursements (counsel’s fees, court fees, e-discovery fees and all other fees ancillary to the case).